There are weekly news and opinion stories coming out regarding breakthrough revelations or protests concerning Donald Trump’s failure to make public his tax returns. While we all wait for Wikileaks to succeed in their call for a leak, there are actually already a several dozen publicly available records from Trump’s holdings.

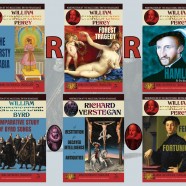

The United States Securities and Exchange Commission has annual Form 10-Ks from 1995 to 2005 for one of Trump’s only publicly held companies, Trump Hotels & Casino Resorts, Inc., with a headquarters at 1000 Boardwalk in Atlantic City, New Jersey. This holding is one of Trump’s biggest bankrupted failures, as the 1995 report shows it was at $494,471 in total long-term debt when Trump took over as Chairman and took the company public, and by 2005, after annual operations losses, it ended up with “$1.8 billion aggregate principal amount of public indebtedness.”

Figure 1: 1995 Corporate Long-Term Debt

Trump started paying himself a salary of $1 million in 1995, and this ballooned over the decades because of agreements that guaranteed that he’d profit as the company was collapsing. The 2005 form was filed after the company’s first bankruptcy in 2004, and no forms are available past this point, as it went bankrupt again in 2009 and then filed for Chapter 11 in 2014. This problem of chairmen taking on billions in debt while they make a significant percentage as a salary and then let the company fail is common to many other enormous corporate collapses of the last decade, including the two biggest bankruptcy filings in America in 2008: Lehman Brothers ($691 billion) and Washington Mutual ($328).

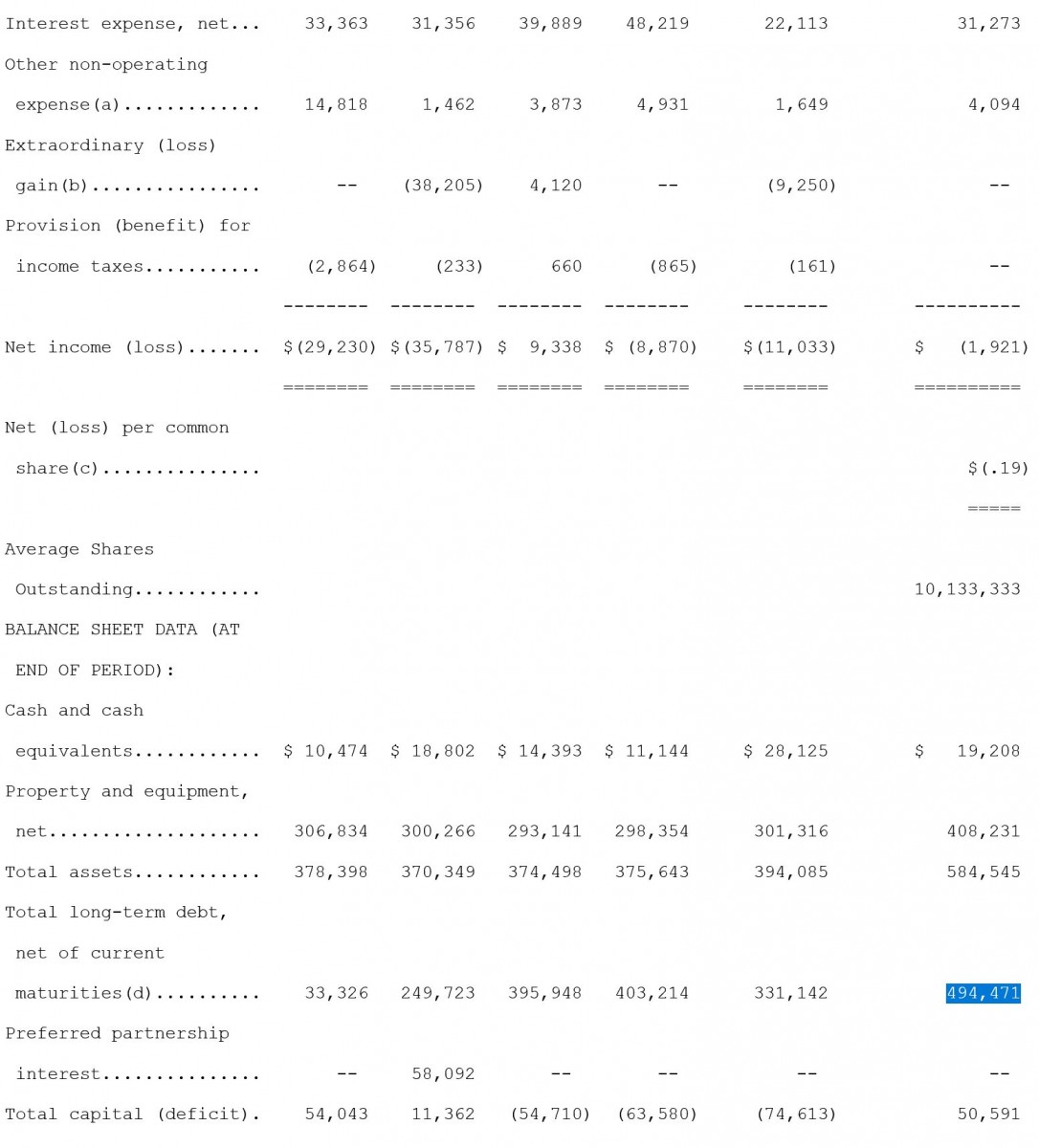

Deregulation has meant that a chairman has unlimited power regarding how a company might attempt to make a profit and it is easier to manipulate this system than to make an honest sale, especially when it comes to gambling in investments or slot machines. In a quarter following Trump’s bankruptcy, 10-K shows that operating expenses were $328,578, which when it is combined with other expenses, was less than the revenues of $379,874; any sound business operator would have made cuts to have attempt to fix the crisis, but the spending continued, or at least this business should’ve closed as it was losing money just by keeping its doors open. These documents include curious details such as that the “Slot Win Percentage” for the casinos was 7.8%, a number gamblers can learn from. The occupancy rate for the hotel rooms in 2005 was 81.6%. There is also a note about a non-operating expense from 1991 for “$4 million of costs associated with certain litigation” and the same from 1992 for $1.5 million. Trump has been sued by thousands of civil litigants over slips and falls, and the like, and these contributed to cutting into profit margins. Trump bragged in one of his books that he always makes very cheap and efficient purchasing decisions, but the 1995 statement reports $91 million in furniture, fixtures and equipment purchases as well as $350 million buildings and their improvements despite the negative bottom line with only $195 million in net revenue. This is like a home owner buying new furniture and building a new garage when he can’t make an upcoming mortgage payment.

Figure 2: 1995 Corporate Consolidated Balance Sheet: Furniture

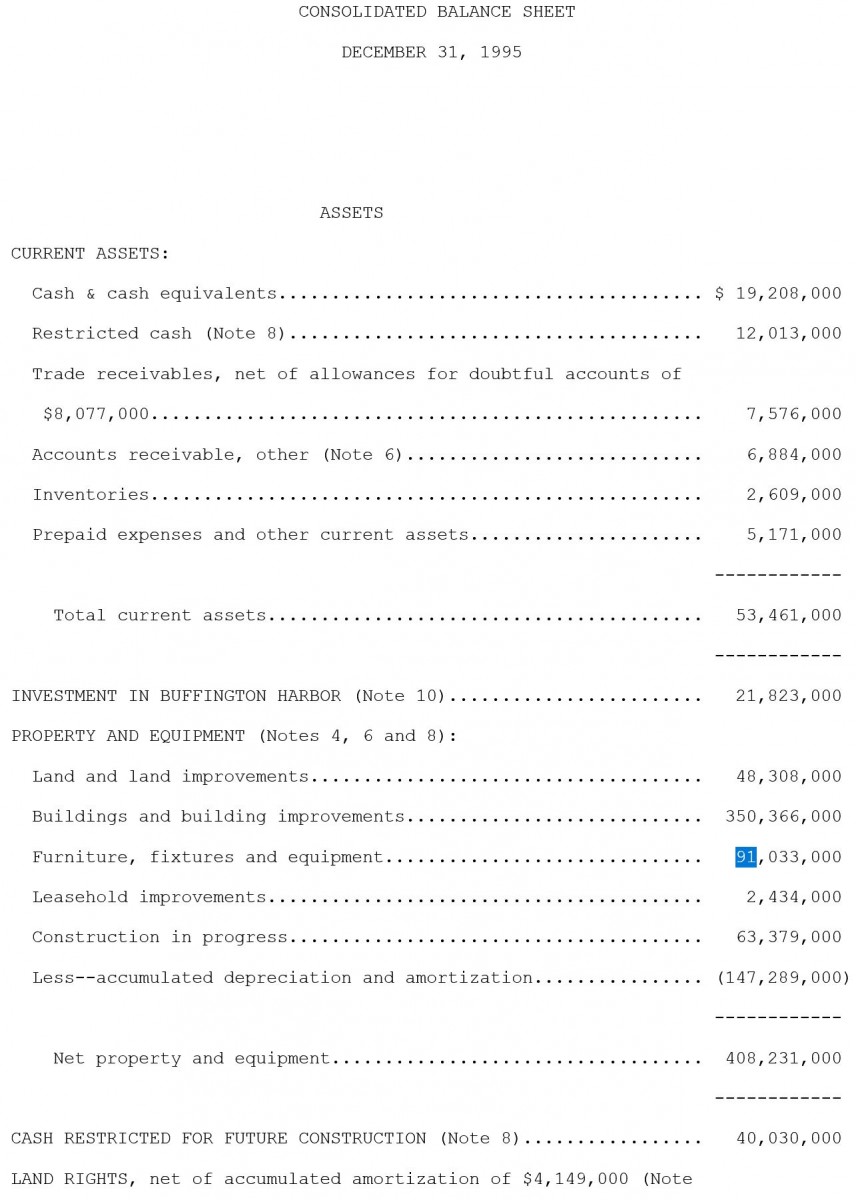

Trump received $52 million as repayment for “certain personal indebtedness” and $35 million in redeemed “Preferred Stock Units.” This would be like a home owner paying himself a salary out of profits from re-financing his home. If occupancy remained at around 82%, why did these casinos expand its hotel rooms numbers from 1,404 in 1995 to 2,884 in 2005? Wouldn’t somebody expand only if a hotel is reaching full occupancy?

Figure 3: 2005 Corporate Report: Number of Guest Rooms

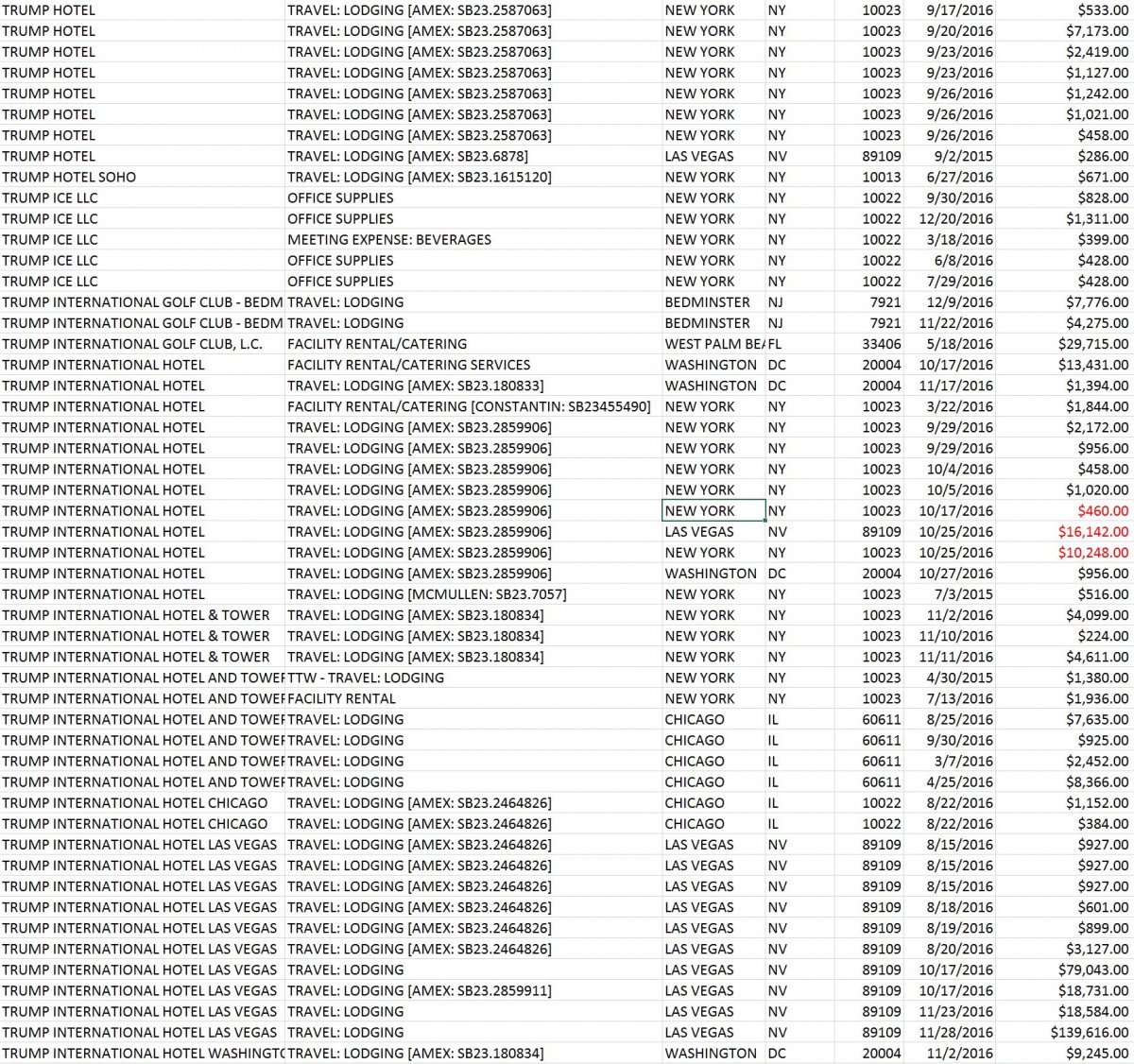

If over-spending is Trump’s philosophy in life, it’s odd that he ended up with a $7.6 million cash on hand out of the $351 million he raised for his election run according to the Federal Election Commission’s 2016 Financial Summary. FEC allows for a download of the exact 30,336 itemized expenses, which reveals things like that Trump spent $250 monthly on a Zoho email account. He also paid $8,220 to rent Youngstown State University’s space (I always assumed politicians were paid an honorarium to present). The largest payments were made to the American Media & Advocacy Group (with cramped shared office space in Virginia), totaling $74 million for placed media. This shady group still has no website and all it does is purchase ads on behalf of conservative candidates (it’s unclear why they can’t buy the ad space directly from the networks). He paid $88 million to a marketing firm, Giles-Parscale. And it looks like he actually did pay at least one of his pollsters, Cambridge Analytica, $6 million.

The dramatic messages that Trump sent out during his campaign were crafted by Jamestown Associates for $8.8 million. His favorite hotel on the campaign trail seems to have been Marriott Hotels, where he spent $216,692, with nightly room rates at over $100; though if he had spent only $100 nightly for a year his total hotel expenses for a year would have been $36,500. The press has been running stories regarding Trump’s excessive spending of campaign funds on his own businesses, so I added up all of the items that started with Trump and these came up to $4.1 million, including costs of travel expenses for his relatives, payroll for himself, and payments for his own hotels, restaurants (one meal cost $174) and the like. Oddly enough, Trump billed for lodging in New York on 10/17 and 10/25 and might have stayed in Las Vegas at the Trump International Hotel for the 8 days in between, piling up $16,142 in charges at over $2,000 per night. Imagine if universities allowed for this type of billing during conference travel. There is an incredible level of detail in this filing, and curious parties can dig up thousands of suspect transactions.

Figure 4: Campaign Expenditures: Trump International Hotel

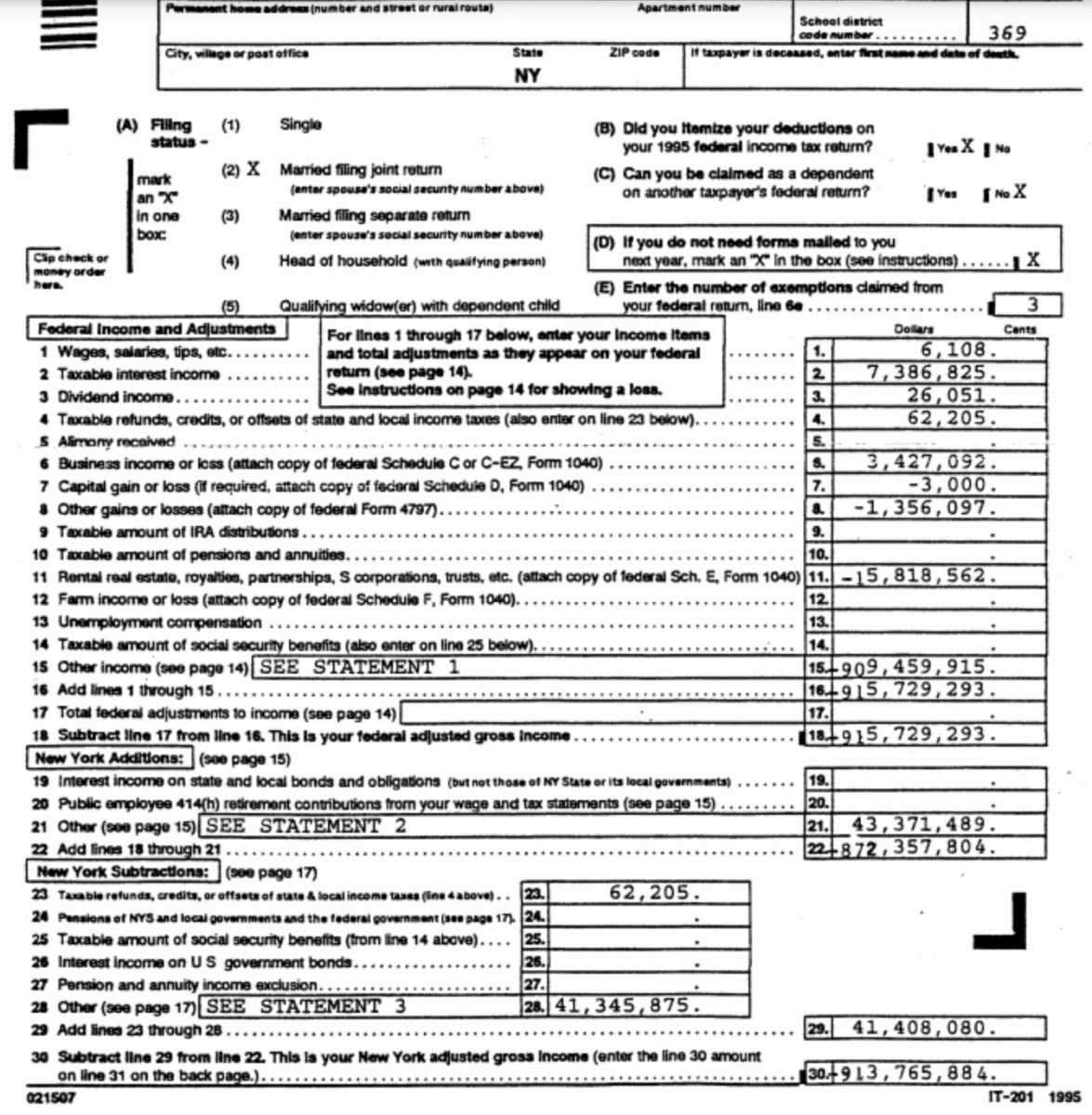

Another helpful source is the first three pages of Trump’s 1995 Income Tax report that The New York Times released back in October, which reports a $913.7 million adjusted gross income, an enormous problem when compared to his reported $3 million business income.

Yet another source with a flood of information is Trump’s Financial Disclosures form, signed on July 15, 2015, which was uploaded by CNBC onto Scribd. The first ten pages are taken up with the names of positions Trump holds outside of the US government, mostly as president/ chairman, including: Dubai Golf Manager (he reported making less than $201 from this position), India Venture, Barra Hotelaria (Brazil), Trump Korea (in which he owns 59%, and the rest seems to be owned by Daewoo American Development Corp, a shell corporation of Daewoo International, Korea’s largest trading company), China Technical Services (also no profits despite over $100,001 invested in shares) and Ireland Enterprises (to mention a few that prove that Trump’s divestment from these engagements is necessary for him to avoid foreign influences). The total profits are estimated here, but adding them up should give an accurate sum of Trump’s net worth, and it definitely does not look like it adds up to $10 billion. Trump is still paying off two mortgages on homes at 1094 S. Ocean Blvd. and 124 Woodbridge Road ($100,000-$500,000) that he took on back in 1993-4. Can you imagine not paying these off if you were a billionaire?

Figure 5: 1995 Resident Income Tax Return: New York State: New York Times

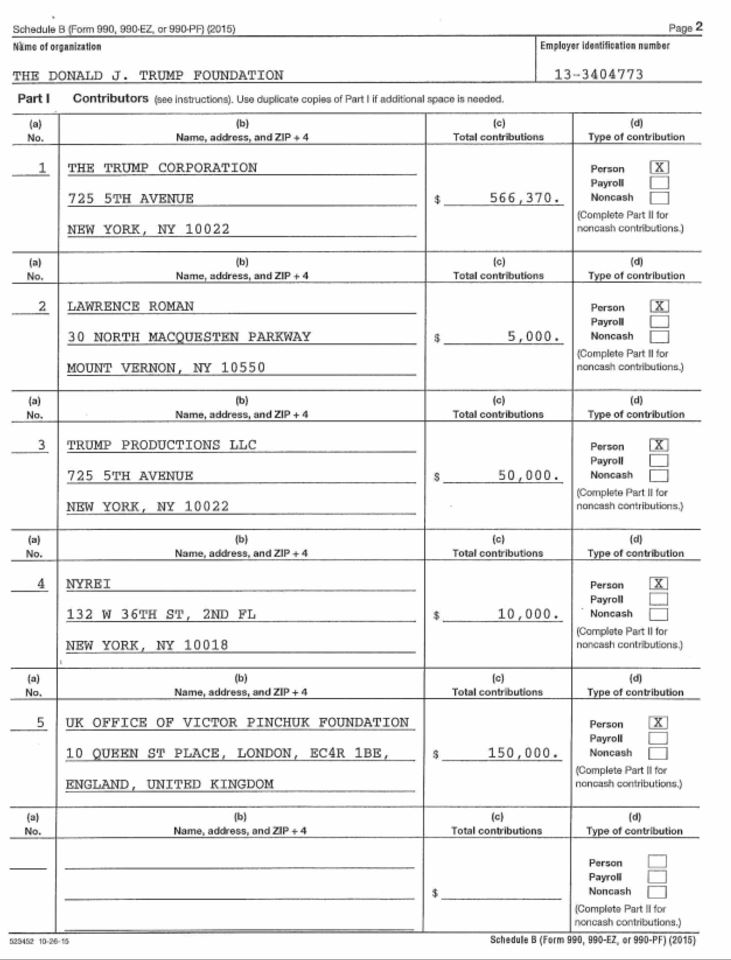

The last breathtaking piece of public information is the Trump Foundation 2015 tax filing made available by The Washington Post. The Foundation’s distributions were half the $1 million given away in 2010 by 2014 ($596,700), in contrast with $901,685 that was paid to keep it running. The donation to the American Conservative Union Foundation of $50,000 just as Trump was preparing to run on a conservative platform seems to be self-interested. $150,000 out of the amount awarded was a donation to the foundation by the Victor Pinchuk Foundation (Ukraine) in exchange for a pro-Ukraine conference call Trump made after becoming a candidate.

Figure 6. Trump Foundation Report

The Post’s David Fahrenthold has written a few fantastic articles regarding Trump’s Foundation, including the November 22 piece that proclaims that Trump admitted to violating the ban on self-dealing in the 2015 tax form, meaning that Trump donated money to himself or members of his family that year and previously. David stresses that “from 2009 until this year, the charity was funded exclusively with other people’s money,” and during the presidential campaign Trump used at least $300,000 from the foundation to “help himself” in settling legal disputes by donating to the injured party’s charity, and for purchasing artwork and memorabilia that Trump then displayed on personal or business premises. While David states that it is unclear from this return exactly how Trump was self-dealing, I think the line about the Conservative Union and an incoming payment from a Ukrainian foundation offer telling clues.

Based on this close review of Trump’s available tax records, it is easy to project what his latest tax return will state. It will report a net operative loss, and it will claim the benefit of past bankruptcies to avoid paying taxes on current profits. The millions Trump spent on hotels, food and entertainment during the campaign will be written off as expenses. He will surely still owe money for the two houses he bought in the nineties. He will maintain chairmanships in some suspect foreign corporations, despite reporting no profits from many of these activities.

Meanwhile, he will also write off millions for suing to suppress the freedom of the press, as he complains of libel (i.e., negative publicity). And he will pay himself even more for all of his non-divested conflicts-of-interest chairmanships while he is president than he paid when he was running for the spot. I hope this glimpse into the unknown will help those who have been reading this mystery under suspense, and might now suspect that Trump will never reveal the conclusion himself.

Sources of Information:

www.getfilings.com

www.getfilings.com

www.sec.gov

www.hoovers.com

www.fec.gov

www.nytimes.com

www.scribd.com

washingtonpost

washingtonpost